9, Apr 2024

Navigating Property In San Juan County, New Mexico: Understanding The Assessor’s Map

Navigating Property in San Juan County, New Mexico: Understanding the Assessor’s Map

Related Articles: Navigating Property in San Juan County, New Mexico: Understanding the Assessor’s Map

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Property in San Juan County, New Mexico: Understanding the Assessor’s Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Property in San Juan County, New Mexico: Understanding the Assessor’s Map

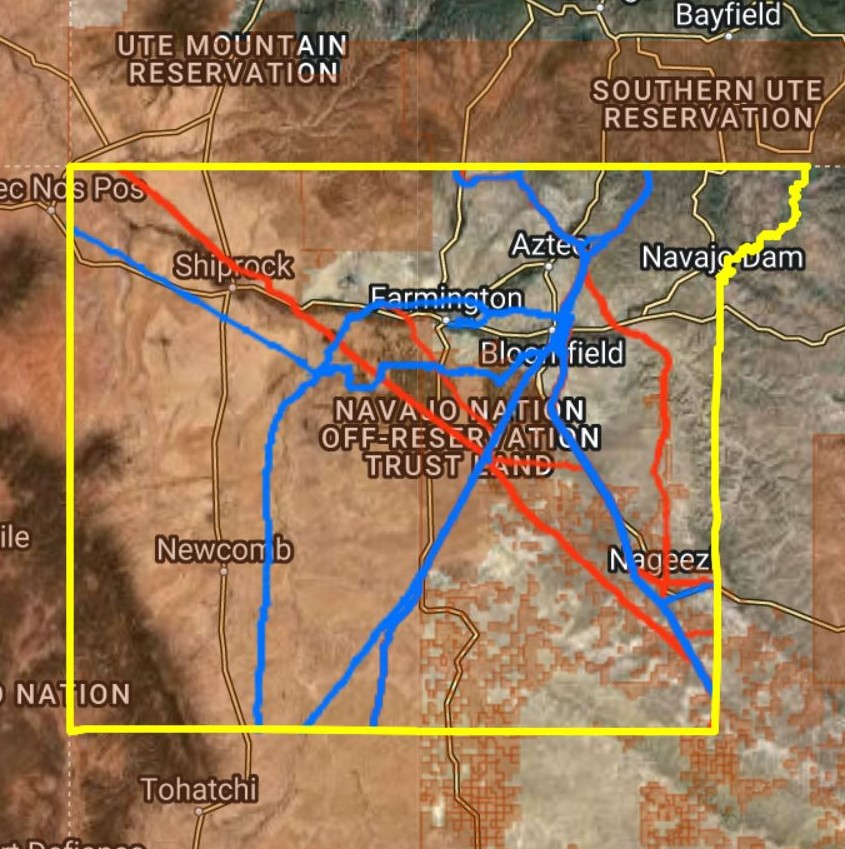

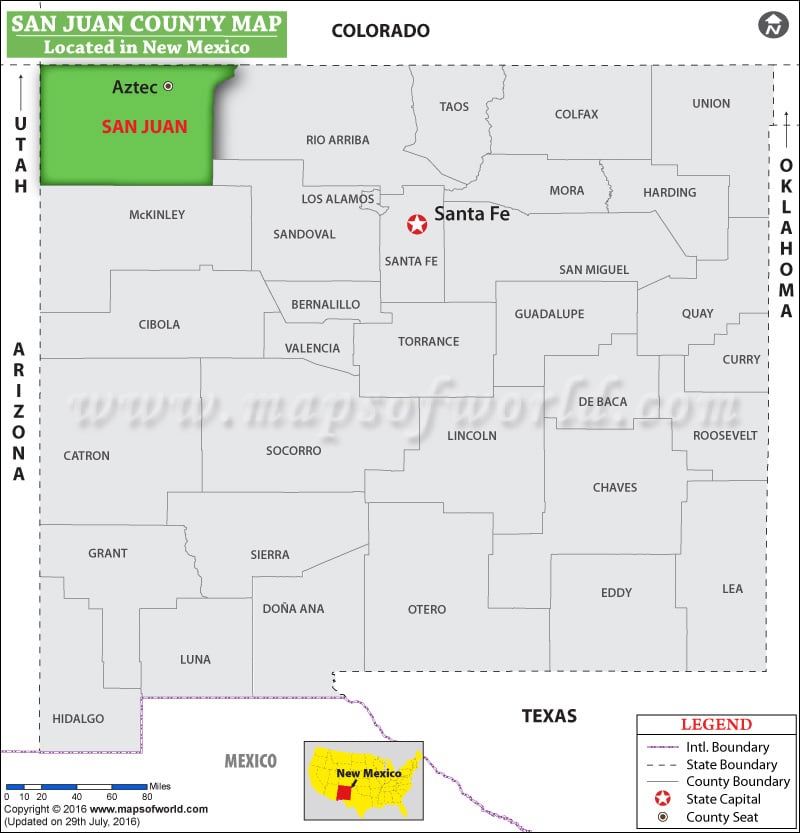

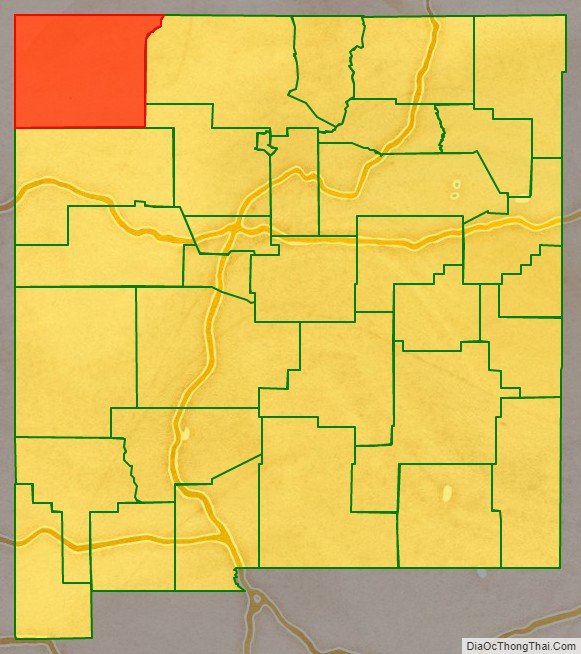

San Juan County, New Mexico, a sprawling landscape of mesas, canyons, and the iconic Four Corners region, holds a diverse tapestry of property types. From bustling urban centers to remote rural homesteads, the county’s real estate market reflects its unique geographic and cultural identity. Understanding the intricacies of this market requires a comprehensive resource: the San Juan County Assessor’s Map.

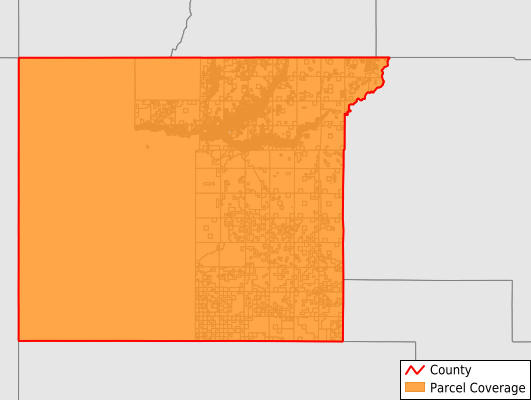

This map, a crucial tool for property owners, investors, and government agencies alike, serves as a visual representation of the county’s real estate landscape. It provides detailed information about individual properties, including their location, boundaries, ownership, and assessed value. This data is crucial for various purposes, ranging from property tax calculations to land planning and development.

Delving into the Details: A Closer Look at the Assessor’s Map

The San Juan County Assessor’s Map is not merely a static image; it’s a dynamic database that constantly updates to reflect changes in property ownership, valuations, and other relevant information. This intricate system is built on a foundation of:

- Parcel Numbers: Each property in San Juan County is assigned a unique parcel number, serving as its digital identifier. These numbers are displayed on the map and link to detailed property records within the Assessor’s database.

- Property Boundaries: The map accurately depicts the boundaries of each parcel, ensuring clarity regarding ownership and preventing potential disputes.

- Land Use Classifications: The map categorizes properties based on their designated use, such as residential, commercial, agricultural, or industrial. This information is vital for zoning regulations and planning purposes.

- Assessed Values: The Assessor’s Map displays the assessed value of each property, a crucial factor in calculating property taxes. These values are determined through a complex process that considers factors like market conditions, property improvements, and land characteristics.

- Property Ownership: The map clearly indicates the current owner of each parcel, facilitating property transactions and ensuring accurate records.

The Importance of the Assessor’s Map: A Multifaceted Resource

The San Juan County Assessor’s Map serves as a vital tool for a wide range of stakeholders:

- Property Owners: The map provides owners with a clear understanding of their property’s boundaries, assessed value, and other essential information. This knowledge empowers them to make informed decisions regarding property maintenance, improvements, and potential sales.

- Real Estate Professionals: Real estate agents and brokers rely on the Assessor’s Map to identify potential properties, assess their value, and guide clients through the buying or selling process. The map’s detailed information streamlines property transactions and facilitates accurate appraisals.

- Government Agencies: The Assessor’s Map is indispensable for county planning and development departments. It provides insights into land use patterns, property values, and population density, informing decisions regarding zoning, infrastructure development, and public services.

- Investors: Investors seeking opportunities in San Juan County can leverage the Assessor’s Map to identify properties with potential for growth or development. The map’s data provides valuable insights into market trends, land values, and potential risks.

- Taxpayers: The map helps taxpayers understand how their property taxes are calculated and provides a transparent overview of the county’s property valuation process.

Accessing the Assessor’s Map: A Guide for Users

The San Juan County Assessor’s Office offers various methods for accessing the map and its associated data:

- Online Portal: The Assessor’s website provides a user-friendly online portal where users can search for specific properties, view their details, and download maps.

- Public Records: The Assessor’s Office maintains public records that are open to inspection during business hours.

- In-Person Assistance: The Assessor’s staff is available to provide assistance with map navigation, property searches, and other inquiries.

FAQs: Addressing Common Questions

Q: How can I find the assessed value of my property on the map?

A: The assessed value of each property is displayed directly on the Assessor’s Map. You can also access this information through the online portal by entering your parcel number or property address.

Q: What information is included in the property records associated with the map?

A: Property records contain detailed information about each parcel, including ownership history, legal descriptions, improvements, and tax assessments.

Q: How often is the Assessor’s Map updated?

A: The Assessor’s Map is updated regularly to reflect changes in property ownership, valuations, and other relevant data.

Q: Can I use the Assessor’s Map to determine the market value of my property?

A: While the Assessor’s Map provides valuable information about property values, it’s important to note that assessed values are not necessarily equivalent to market values. Market values are determined through appraisals conducted by licensed professionals.

Q: What are the different land use classifications displayed on the map?

A: The map categorizes properties based on their designated use, such as residential, commercial, agricultural, industrial, and vacant land.

Tips for Effective Map Utilization

- Familiarize Yourself with the Map’s Features: Take time to understand the map’s layout, symbols, and navigation tools.

- Utilize Search Functions: The online portal and public records offer search functions that streamline property identification.

- Contact the Assessor’s Office for Assistance: The Assessor’s staff is available to answer questions and provide guidance.

- Consult with Real Estate Professionals: For complex property transactions or valuation inquiries, seek advice from licensed real estate professionals.

Conclusion: A Foundation for Informed Decisions

The San Juan County Assessor’s Map is more than just a visual representation of property locations; it’s a vital tool for understanding the county’s real estate landscape. Its comprehensive data empowers property owners, investors, government agencies, and taxpayers to make informed decisions based on accurate and up-to-date information. By leveraging this resource, stakeholders can navigate the complex world of San Juan County real estate with greater clarity and confidence.

Closure

Thus, we hope this article has provided valuable insights into Navigating Property in San Juan County, New Mexico: Understanding the Assessor’s Map. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin