10, Aug 2023

Navigating The Complexities Of Wealth: A Comprehensive Guide To Emap Wealth Management

Navigating the Complexities of Wealth: A Comprehensive Guide to Emap Wealth Management

Related Articles: Navigating the Complexities of Wealth: A Comprehensive Guide to Emap Wealth Management

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Complexities of Wealth: A Comprehensive Guide to Emap Wealth Management. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Complexities of Wealth: A Comprehensive Guide to Emap Wealth Management

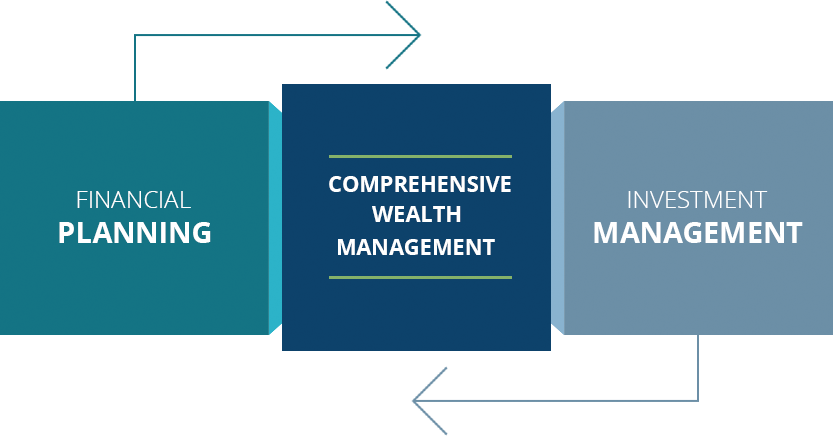

The pursuit of financial well-being is a universal aspiration, yet the path to achieving it can be intricate and demanding. As individuals accumulate wealth, the need for expert guidance to navigate its complexities becomes increasingly apparent. This is where emap wealth management emerges as a vital tool, offering a structured approach to safeguarding, growing, and strategically utilizing financial resources.

Understanding the Essence of Emap Wealth Management

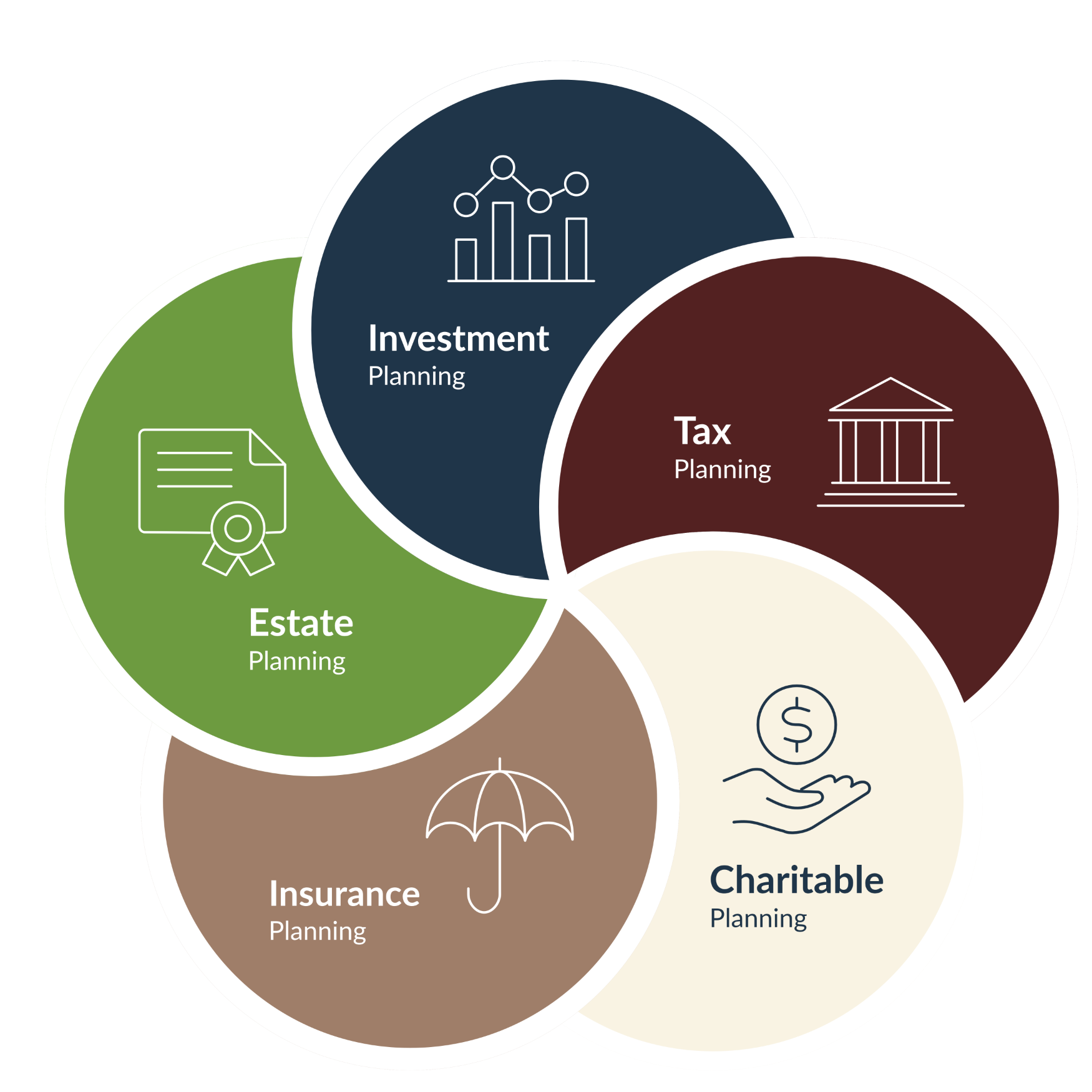

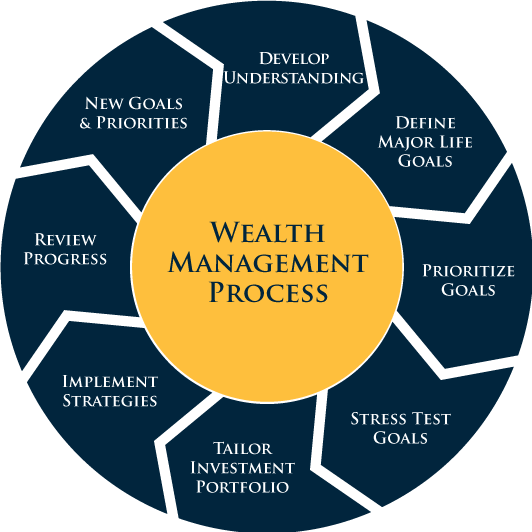

Emap wealth management encompasses a multifaceted approach to managing financial assets, encompassing investment strategies, risk management, tax optimization, estate planning, and philanthropic endeavors. It is a holistic process that considers the individual’s unique circumstances, goals, and risk tolerance to craft a personalized financial roadmap.

Key Components of Emap Wealth Management

1. Investment Strategy: At the heart of emap wealth management lies the creation and implementation of a carefully crafted investment strategy. This involves:

- Asset Allocation: Determining the optimal distribution of assets across various investment classes, such as stocks, bonds, real estate, and alternative investments. This allocation is tailored to the individual’s risk tolerance, time horizon, and financial objectives.

- Security Selection: Choosing specific securities within each asset class based on rigorous research, analysis, and market understanding.

- Portfolio Management: Continuously monitoring and adjusting the portfolio’s composition to ensure alignment with the investment strategy and evolving market conditions. This includes rebalancing, adjusting asset allocation, and capitalizing on market opportunities.

2. Risk Management: Managing risk is an integral aspect of emap wealth management. This involves:

- Identifying and Assessing Risks: Analyzing potential threats to the financial portfolio, including market volatility, inflation, and interest rate fluctuations.

- Developing Mitigation Strategies: Implementing measures to minimize or offset potential risks, such as diversification, hedging, and insurance.

- Monitoring and Adjusting Risk Tolerance: Regularly reviewing the individual’s risk appetite and adjusting the investment strategy accordingly to ensure comfort and alignment with their financial goals.

3. Tax Optimization: Emap wealth management emphasizes tax efficiency. This involves:

- Understanding Tax Laws: Staying abreast of relevant tax regulations and legislation to leverage tax advantages and minimize tax liabilities.

- Tax Planning: Developing strategies to optimize tax efficiency, such as utilizing tax-advantaged accounts, structuring investments strategically, and claiming eligible deductions.

- Tax Compliance: Ensuring adherence to all tax regulations and timely filing of tax returns.

4. Estate Planning: Emap wealth management encompasses comprehensive estate planning, which involves:

- Will and Trust Creation: Establishing legal documents to ensure the distribution of assets according to the individual’s wishes upon their passing.

- Succession Planning: Identifying and preparing potential successors to manage assets and ensure continuity of financial affairs.

- Minimizing Estate Taxes: Implementing strategies to minimize estate taxes and ensure the efficient transfer of wealth to beneficiaries.

5. Philanthropic Planning: Emap wealth management also assists in incorporating philanthropic endeavors into the financial plan. This involves:

- Identifying Charitable Interests: Understanding the individual’s charitable goals and passions.

- Developing a Giving Strategy: Creating a structured plan for making charitable contributions that aligns with their financial resources and objectives.

- Maximizing Charitable Impact: Utilizing tax-efficient methods to maximize the impact of charitable giving while minimizing tax liabilities.

Benefits of Emap Wealth Management

- Financial Security and Peace of Mind: Emap wealth management provides a framework for safeguarding and growing wealth, offering peace of mind knowing that financial affairs are being professionally managed.

- Personalized Financial Roadmap: It offers a tailored approach to financial planning, considering individual circumstances, goals, and risk tolerance to create a customized financial roadmap.

- Expert Guidance and Support: Access to experienced professionals with deep knowledge of financial markets, investment strategies, and tax regulations.

- Proactive Risk Management: Implementing strategies to mitigate financial risks and protect assets from market volatility and unforeseen events.

- Efficient Tax Planning: Leveraging tax advantages and minimizing tax liabilities through strategic investment planning and tax optimization strategies.

- Streamlined Estate Planning: Ensuring a smooth transfer of wealth to beneficiaries through comprehensive estate planning, minimizing potential legal complications and tax burdens.

- Philanthropic Fulfillment: Facilitating the realization of philanthropic goals through structured giving strategies and tax-efficient methods.

FAQs by Emap Wealth Management

1. What are the qualifications required to engage in emap wealth management?

There are no specific qualifications required to engage in emap wealth management. Individuals of all ages, income levels, and asset sizes can benefit from professional guidance.

2. How do I choose the right emap wealth management firm?

Choosing the right firm requires careful research and consideration. Factors to consider include:

- Experience and Expertise: Look for a firm with a proven track record in managing wealth and a team of experienced professionals.

- Investment Philosophy and Approach: Ensure the firm’s investment philosophy aligns with your risk tolerance and investment goals.

- Fees and Transparency: Understand the firm’s fee structure and ensure transparency in their operations.

- Client Testimonials and Reviews: Seek feedback from existing clients to gain insights into the firm’s performance and client satisfaction.

3. What is the typical fee structure for emap wealth management services?

Fees vary depending on the firm, the scope of services, and the size of the assets being managed. Common fee structures include:

- Percentage-Based Fees: A percentage of the assets under management.

- Hourly Fees: Charged for specific services, such as financial planning or tax preparation.

- Flat Fees: A fixed fee for specific services, regardless of the asset size.

4. How often should I review my emap wealth management plan?

It is recommended to review your financial plan annually, or more frequently if there are significant life changes or market fluctuations. Regular reviews ensure that your plan remains aligned with your evolving goals and risk tolerance.

5. Is emap wealth management only for high-net-worth individuals?

While emap wealth management can be particularly beneficial for individuals with significant assets, it is not exclusive to the wealthy. Individuals with modest assets can also benefit from professional guidance in managing their finances and achieving their financial goals.

Tips by Emap Wealth Management

- Start Early: Begin planning for your financial future early in life, even if you have limited assets. The earlier you start, the more time you have to grow your wealth and achieve your financial goals.

- Set Clear Financial Goals: Define your financial objectives, such as retirement planning, education savings, or homeownership. Having clear goals provides direction and motivation for your financial decisions.

- Develop a Budget: Track your income and expenses to understand your spending patterns and identify areas for potential savings.

- Diversify Your Investments: Spread your investments across different asset classes to mitigate risk and potentially enhance returns.

- Seek Professional Guidance: Consult with a qualified financial advisor to create a personalized financial plan and receive ongoing support in managing your wealth.

- Stay Informed: Keep abreast of financial market trends, economic developments, and relevant tax legislation to make informed financial decisions.

Conclusion by Emap Wealth Management

Emap wealth management plays a pivotal role in navigating the complexities of wealth accumulation, preservation, and strategic utilization. By offering a holistic approach to financial planning, it empowers individuals to achieve their financial goals, secure their financial future, and make informed decisions to optimize their financial well-being. As individuals strive to secure their financial future, engaging with emap wealth management can provide the necessary expertise, guidance, and support to navigate the intricacies of wealth management and achieve lasting financial success.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Complexities of Wealth: A Comprehensive Guide to Emap Wealth Management. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin