15, Jan 2024

Navigating The Complexities Of Wealth Management: A Comprehensive Guide

Navigating the Complexities of Wealth Management: A Comprehensive Guide

Related Articles: Navigating the Complexities of Wealth Management: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Complexities of Wealth Management: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Complexities of Wealth Management: A Comprehensive Guide

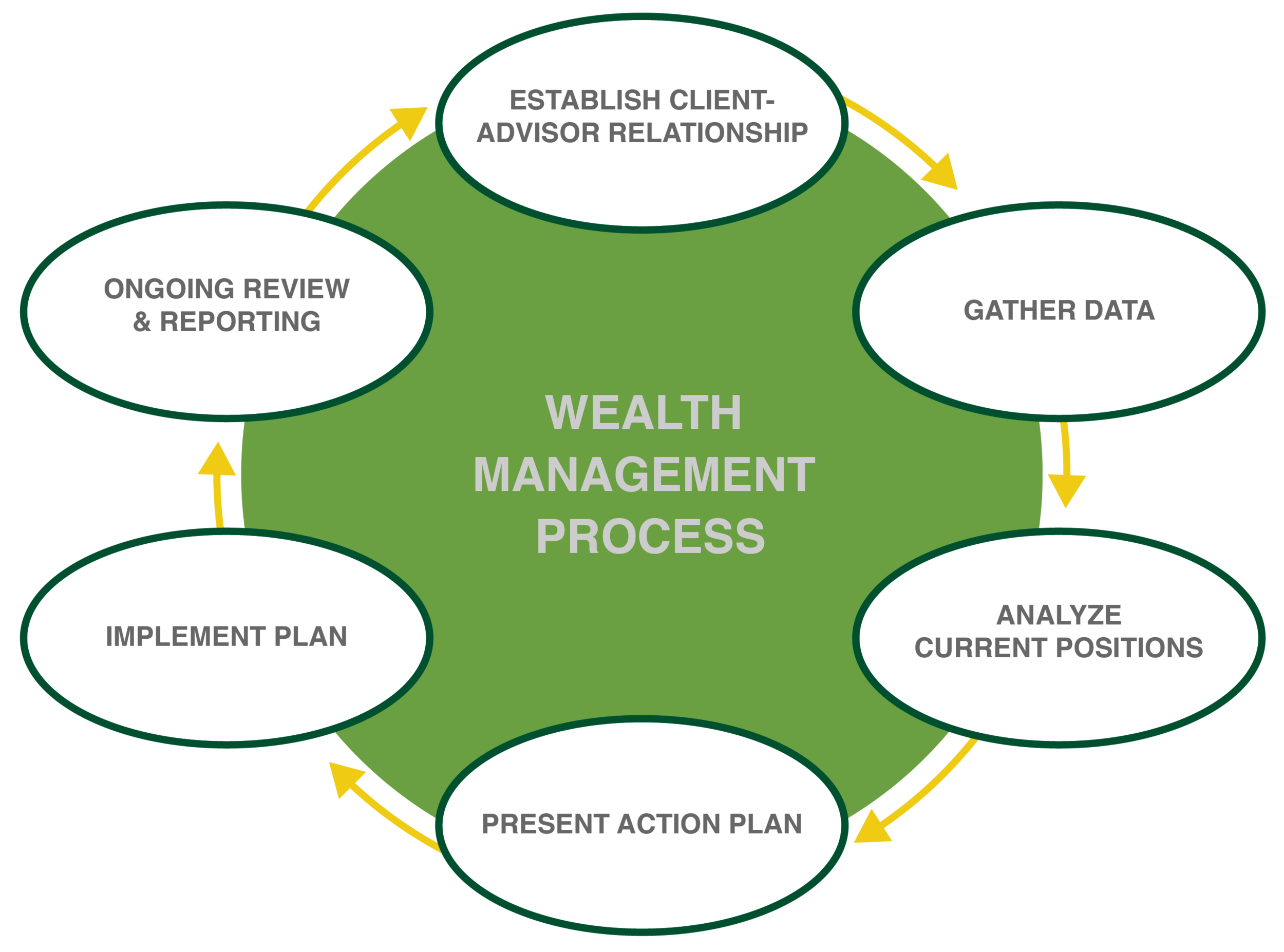

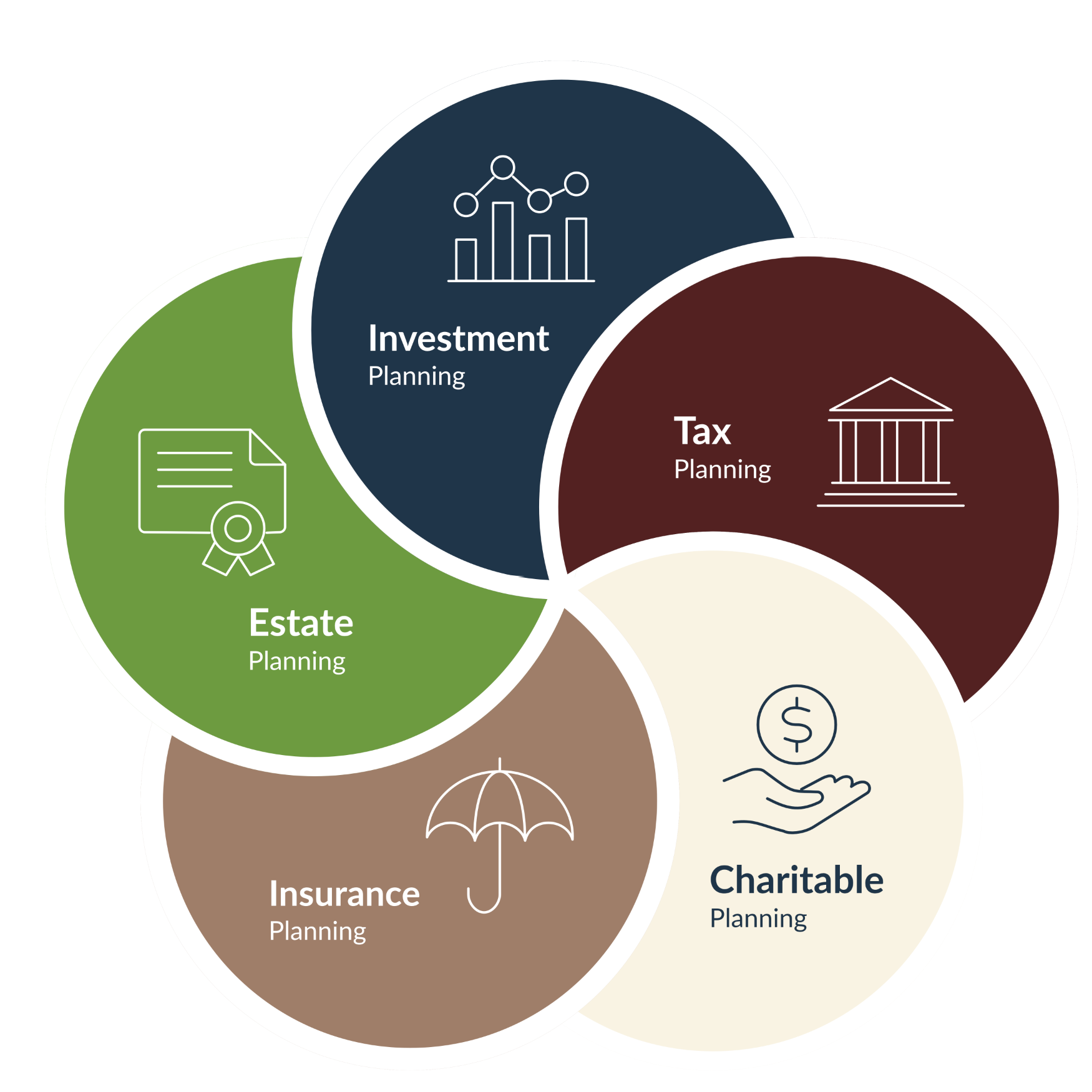

Wealth management is a multifaceted field that encompasses a wide range of financial services designed to help individuals and families preserve, grow, and transfer their wealth across generations. It requires a holistic approach that considers various aspects, including investment strategies, financial planning, tax optimization, estate planning, and risk management.

While many financial institutions offer wealth management services, the scope and expertise can vary significantly. This article aims to provide a comprehensive overview of wealth management, focusing on the services and expertise offered by SunTrust, a reputable financial institution with a long history of serving clients.

Understanding the Core Pillars of Wealth Management

Wealth management is not a one-size-fits-all solution. It is tailored to individual needs and goals, and its core pillars can be categorized as follows:

- Investment Management: This involves selecting and managing investments based on the client’s risk tolerance, investment horizon, and financial goals. It encompasses a wide range of asset classes, including stocks, bonds, real estate, and alternative investments.

- Financial Planning: This involves creating a comprehensive financial plan that addresses various aspects, including budgeting, debt management, insurance planning, retirement planning, and college savings.

- Tax Optimization: This involves minimizing tax liabilities through strategic tax planning, including utilizing tax deductions, credits, and exemptions.

- Estate Planning: This involves planning for the distribution of assets after death, ensuring that the client’s wishes are carried out and minimizing estate taxes.

- Risk Management: This involves identifying and mitigating potential risks that could impact the client’s wealth, such as market volatility, inflation, and unforeseen events.

SunTrust’s Approach to Wealth Management

SunTrust, a leading financial institution, offers a comprehensive suite of wealth management services designed to meet the diverse needs of its clients. The institution’s approach is characterized by:

- Personalized Service: SunTrust believes in building strong relationships with its clients, understanding their unique circumstances and goals, and developing customized solutions.

- Experienced Professionals: SunTrust employs a team of highly experienced and qualified wealth advisors who possess deep knowledge and expertise in various financial disciplines.

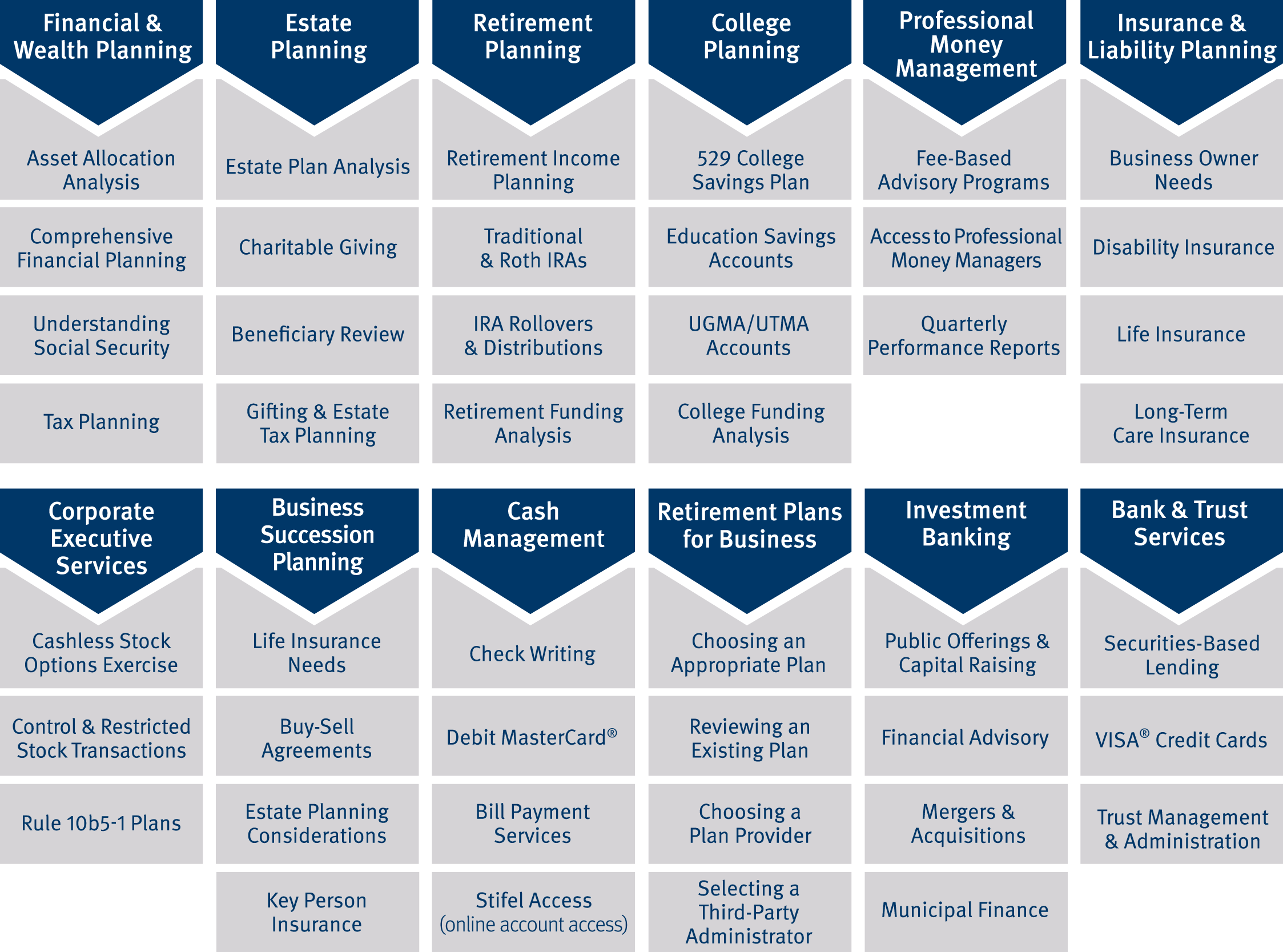

- Comprehensive Solutions: SunTrust offers a wide range of services that address all aspects of wealth management, from investment management and financial planning to tax optimization and estate planning.

- Technology-Driven Approach: SunTrust leverages technology to enhance client experience, providing access to online platforms, mobile applications, and real-time market data.

- Commitment to Integrity: SunTrust adheres to the highest ethical standards, ensuring transparency and accountability in all its dealings.

Benefits of Engaging with SunTrust for Wealth Management

Choosing a reputable financial institution for wealth management is crucial. SunTrust offers several advantages, including:

- Expertise and Experience: SunTrust has a long history of serving clients in the wealth management space, providing deep industry knowledge and expertise.

- Comprehensive Range of Services: SunTrust offers a wide range of services that cater to diverse needs, providing a one-stop solution for all wealth management requirements.

- Personalized Approach: SunTrust emphasizes personalized service, tailoring solutions to individual client needs and goals.

- Strong Financial Strength: SunTrust is a financially sound institution, providing stability and security for client assets.

- Technology-Enabled Solutions: SunTrust leverages technology to enhance client experience, providing convenient access to information and services.

Frequently Asked Questions (FAQs) about SunTrust’s Wealth Management Services

Q: What are the minimum investment requirements for SunTrust’s wealth management services?

A: SunTrust does not have a specific minimum investment requirement for its wealth management services. However, the firm typically focuses on serving clients with significant financial assets.

Q: What are the fees associated with SunTrust’s wealth management services?

A: Fees for SunTrust’s wealth management services vary depending on the specific services utilized and the client’s asset size. The firm typically charges a combination of asset-based fees and hourly rates for advisory services.

Q: How can I schedule a consultation with a SunTrust wealth advisor?

A: You can schedule a consultation with a SunTrust wealth advisor by contacting the firm directly through its website or by calling its customer service line.

Q: What are the qualifications of SunTrust’s wealth advisors?

A: SunTrust’s wealth advisors are highly qualified professionals with extensive experience in financial planning, investment management, and other related fields. Many hold professional certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

Tips for Effective Wealth Management

- Define Your Financial Goals: Clearly define your short-term and long-term financial goals to guide your investment decisions and financial planning.

- Assess Your Risk Tolerance: Understand your comfort level with risk and align your investment portfolio accordingly.

- Diversify Your Investments: Spread your investments across different asset classes to mitigate risk and enhance potential returns.

- Regularly Review Your Portfolio: Periodically review your investment portfolio to ensure it aligns with your changing goals and market conditions.

- Seek Professional Advice: Consult with a qualified financial advisor to develop a comprehensive financial plan and navigate complex financial decisions.

Conclusion

Wealth management is a crucial aspect of financial planning, requiring a comprehensive and holistic approach. SunTrust, with its extensive experience, personalized service, and comprehensive range of solutions, provides a valuable resource for individuals and families seeking to manage their wealth effectively. By understanding the core pillars of wealth management and leveraging the expertise of SunTrust’s wealth advisors, clients can navigate the complexities of wealth management with confidence, achieving their financial goals and ensuring a secure financial future.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Complexities of Wealth Management: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin