29, Apr 2024

Navigating The Complexities Of Wealth Management: A Comprehensive Guide

Navigating the Complexities of Wealth Management: A Comprehensive Guide

Related Articles: Navigating the Complexities of Wealth Management: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Complexities of Wealth Management: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Complexities of Wealth Management: A Comprehensive Guide

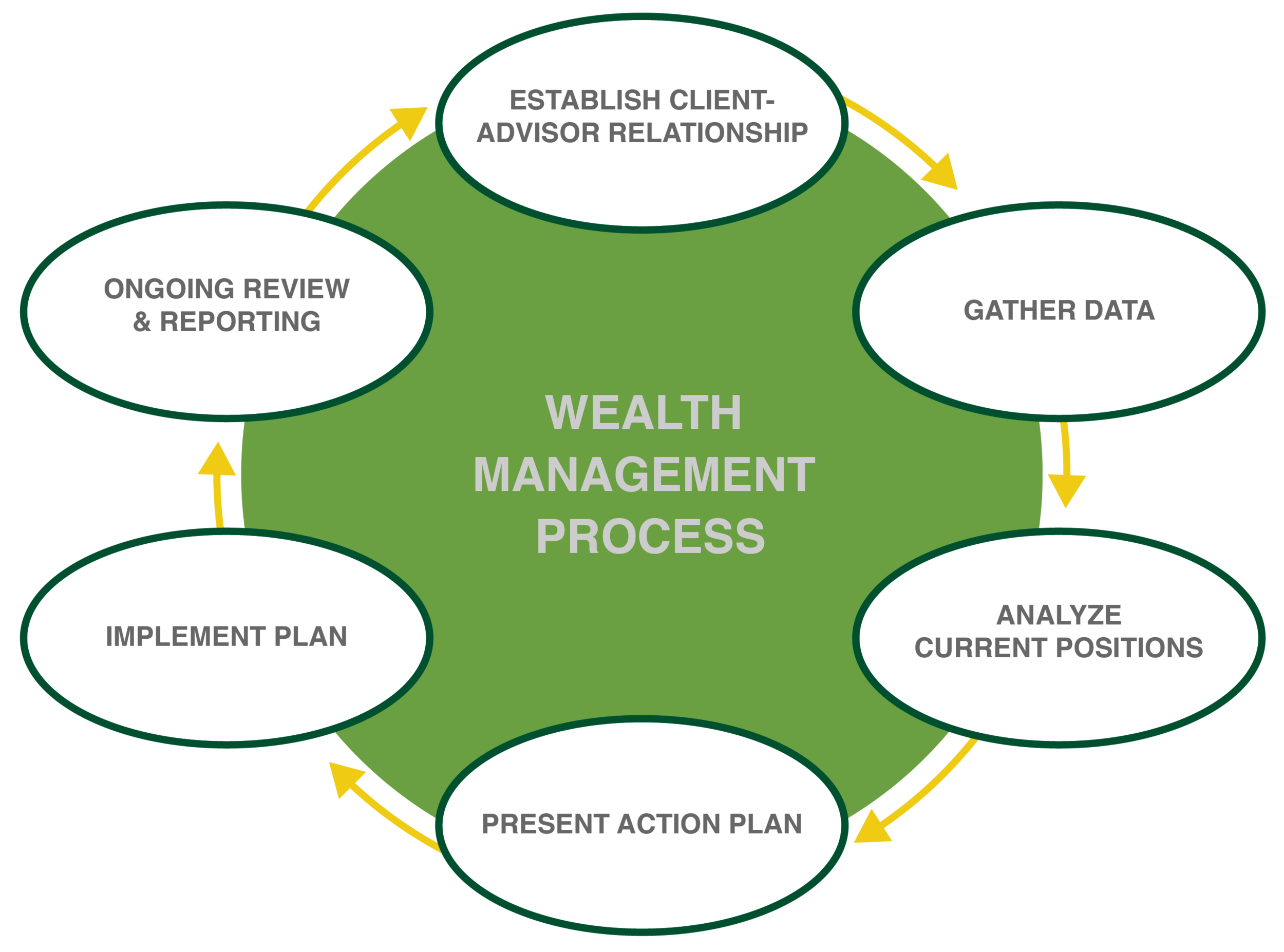

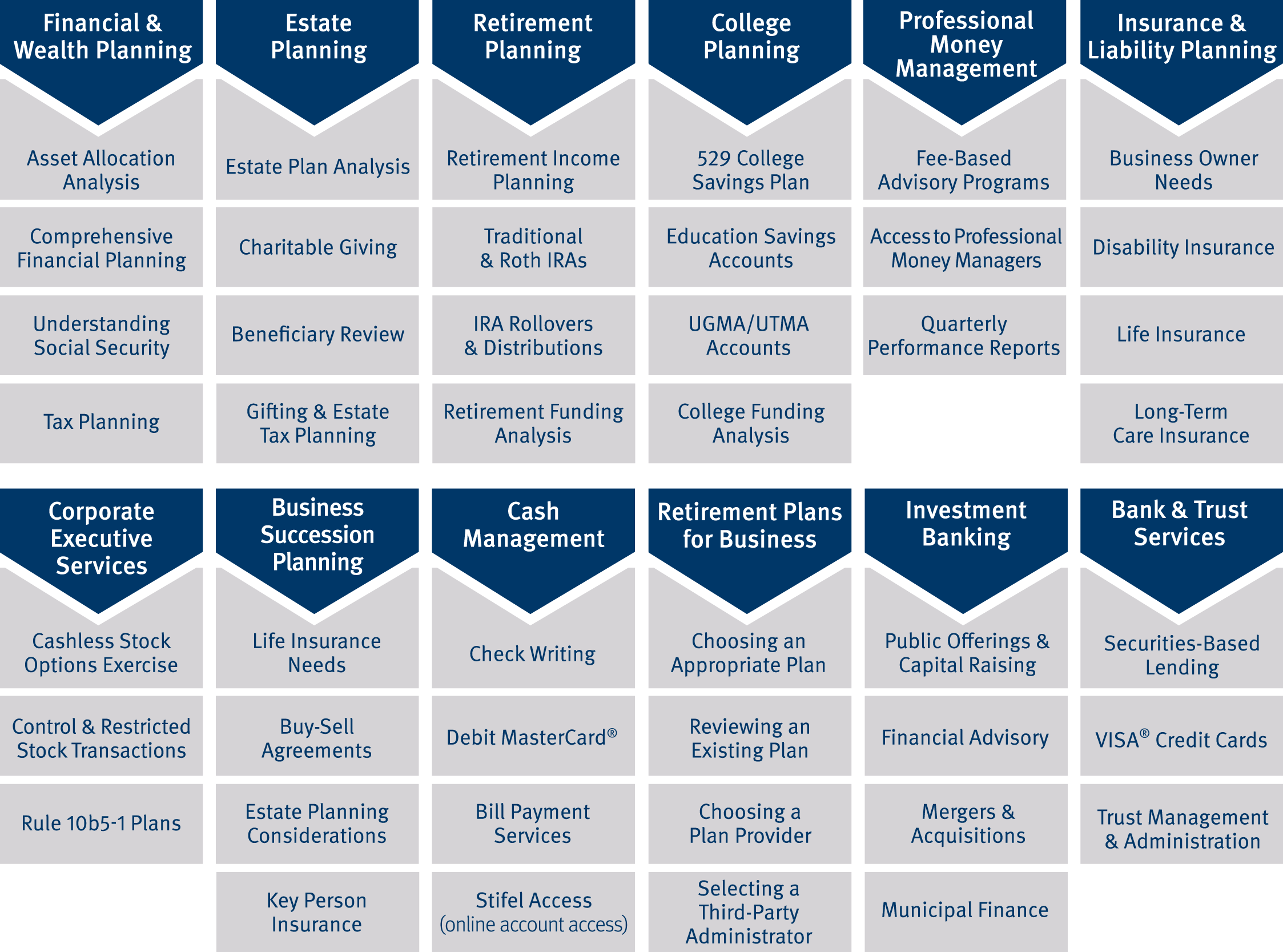

Wealth management, a multifaceted field encompassing financial planning, investment strategies, and estate planning, has become increasingly intricate in the modern world. Individuals and families seeking to safeguard and grow their assets require sophisticated solutions that cater to their unique circumstances and aspirations. This article delves into the intricacies of wealth management, exploring the key aspects that contribute to its success and the challenges that require careful navigation.

Understanding the Landscape of Wealth Management

Wealth management is not a one-size-fits-all approach. It involves a holistic understanding of an individual’s or family’s financial situation, including their current assets, liabilities, income, and spending habits. This information forms the foundation for developing a personalized financial plan that aligns with their goals, risk tolerance, and time horizon.

Key Components of Effective Wealth Management

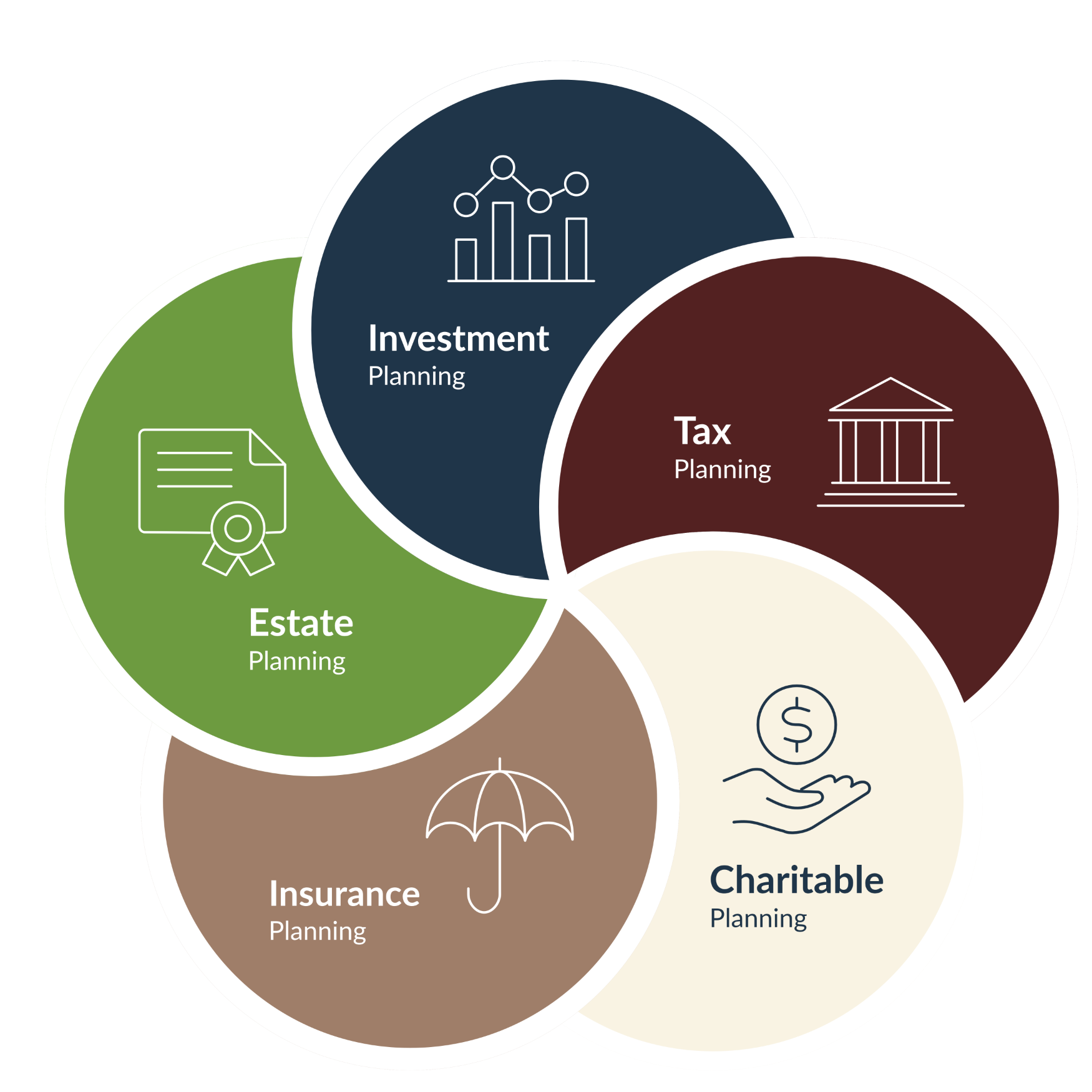

- Financial Planning: This involves analyzing current financial status, setting financial goals, and developing strategies to achieve them. It encompasses budgeting, debt management, savings plans, and retirement planning.

- Investment Management: This involves selecting and managing a portfolio of assets, including stocks, bonds, real estate, and alternative investments, to achieve desired returns while mitigating risk.

- Estate Planning: This involves preparing for the transfer of assets and wealth to future generations. It includes wills, trusts, and other legal documents to ensure a smooth transition and minimize tax liabilities.

- Tax Planning: This focuses on minimizing tax burdens through strategies that optimize deductions and credits, maximizing tax efficiency, and ensuring compliance with tax laws.

- Risk Management: This encompasses identifying and mitigating potential risks that could impact financial stability. This includes insurance planning, asset diversification, and contingency planning.

Benefits of Professional Wealth Management

- Expertise and Knowledge: Wealth managers possess specialized knowledge and experience in financial markets, investment strategies, and tax regulations. They can provide valuable insights and guidance based on their expertise.

- Objectivity and Impartiality: Wealth managers offer an unbiased perspective, helping clients make informed decisions free from emotional biases that can cloud judgment.

- Personalized Strategies: They tailor financial plans and investment strategies to individual circumstances, goals, and risk tolerance, ensuring a customized approach.

- Access to Resources: They have access to a network of professionals, including tax advisors, lawyers, and insurance brokers, who can provide comprehensive support.

- Time Savings: They manage complex financial tasks, freeing up clients to focus on their personal and professional endeavors.

Challenges in Wealth Management

- Market Volatility: Fluctuations in financial markets can impact investment returns and create uncertainty.

- Economic Uncertainty: Global economic conditions, interest rates, and inflation can influence investment decisions and overall financial planning.

- Tax Laws and Regulations: Tax laws and regulations are constantly evolving, requiring ongoing monitoring and adjustments to financial strategies.

- Technological Advancements: The rapid pace of technological innovation requires adapting to new tools and platforms for financial management.

- Succession Planning: Ensuring a seamless transition of wealth to future generations requires careful planning and communication.

Navigating the Future of Wealth Management

The future of wealth management is shaped by evolving technology, changing demographics, and evolving investor preferences. Key trends include:

- Digital Wealth Management: Online platforms and robo-advisors offer automated and personalized financial advice, making wealth management more accessible.

- Sustainable Investing: Growing awareness of environmental, social, and governance (ESG) factors is driving demand for investments aligned with sustainable practices.

- Alternative Investments: Investors are exploring alternative assets, such as private equity, venture capital, and real estate, to diversify portfolios and seek higher returns.

- Global Wealth Management: Increased globalization and cross-border investments require specialized expertise in international tax laws and regulations.

- Family Wealth Management: Growing focus on multi-generational wealth planning, ensuring the transfer of wealth and values across generations.

Conclusion

Wealth management is a complex and evolving field that requires a comprehensive approach. By understanding the key components, benefits, and challenges, individuals and families can navigate the complexities of wealth creation, preservation, and transfer. Engaging with experienced and qualified wealth managers can provide valuable guidance and support in achieving long-term financial goals and securing a prosperous future.

FAQs by emap wealth

1. What is the difference between financial planning and wealth management?

Financial planning is a broader term that encompasses all aspects of managing personal finances, including budgeting, debt management, and savings. Wealth management focuses specifically on managing and growing assets for individuals and families with significant wealth.

2. How do I find a reputable wealth manager?

Look for a wealth manager with experience, qualifications, and a proven track record. Consider their investment philosophy, fees, and communication style. Seek referrals from trusted sources and conduct thorough research.

3. What should I consider when choosing a wealth management firm?

Factors to consider include the firm’s size, experience, investment philosophy, fees, and client services. It’s important to find a firm that aligns with your values, goals, and risk tolerance.

4. How often should I review my financial plan?

It’s recommended to review your financial plan annually or more frequently if significant life changes occur, such as a job change, marriage, or birth of a child.

5. What are the common fees associated with wealth management?

Fees can vary depending on the type of services provided. Common fee structures include asset-based fees, hourly rates, and performance-based fees.

Tips by emap wealth

- Establish Clear Financial Goals: Define your short-term and long-term financial goals, such as buying a home, funding your children’s education, or retiring comfortably.

- Create a Budget: Track your income and expenses to understand your spending habits and identify areas for improvement.

- Manage Debt Wisely: Prioritize paying down high-interest debt and explore strategies for debt consolidation.

- Save Regularly: Make saving a habit, even if it’s a small amount. Consider automating your savings to ensure consistency.

- Diversify Your Investments: Spread your investments across different asset classes to mitigate risk and potentially enhance returns.

- Seek Professional Advice: Consult with a qualified financial advisor to develop a personalized financial plan and receive ongoing guidance.

Conclusion by emap wealth

Wealth management is an essential aspect of achieving financial security and fulfilling your financial aspirations. By taking a proactive approach, establishing clear goals, and seeking professional guidance, you can navigate the complexities of wealth management and build a solid foundation for a prosperous future.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Complexities of Wealth Management: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin