25, Mar 2024

Navigating The Complexities Of Wealth Management: A Comprehensive Guide

Navigating the Complexities of Wealth Management: A Comprehensive Guide

Related Articles: Navigating the Complexities of Wealth Management: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Complexities of Wealth Management: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Complexities of Wealth Management: A Comprehensive Guide

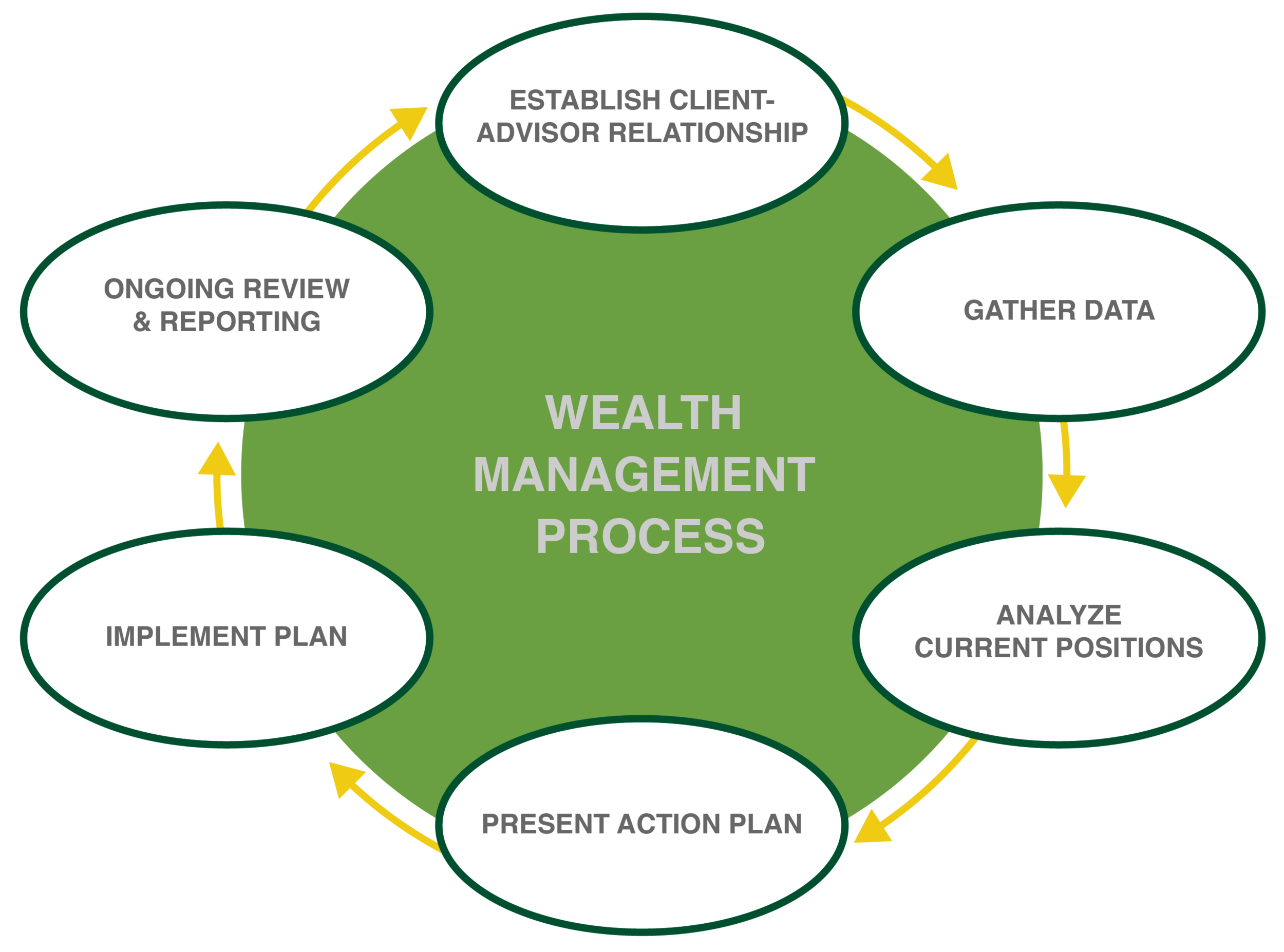

The pursuit of financial security and prosperity is a universal aspiration. However, the path to achieving these goals is often fraught with complexities, demanding a comprehensive understanding of investment strategies, financial planning, and market dynamics. This is where the role of a wealth advisor becomes paramount. A wealth advisor acts as a trusted guide, providing personalized strategies and expert guidance to help individuals and families navigate the intricate world of wealth management.

Understanding the Role of a Wealth Advisor

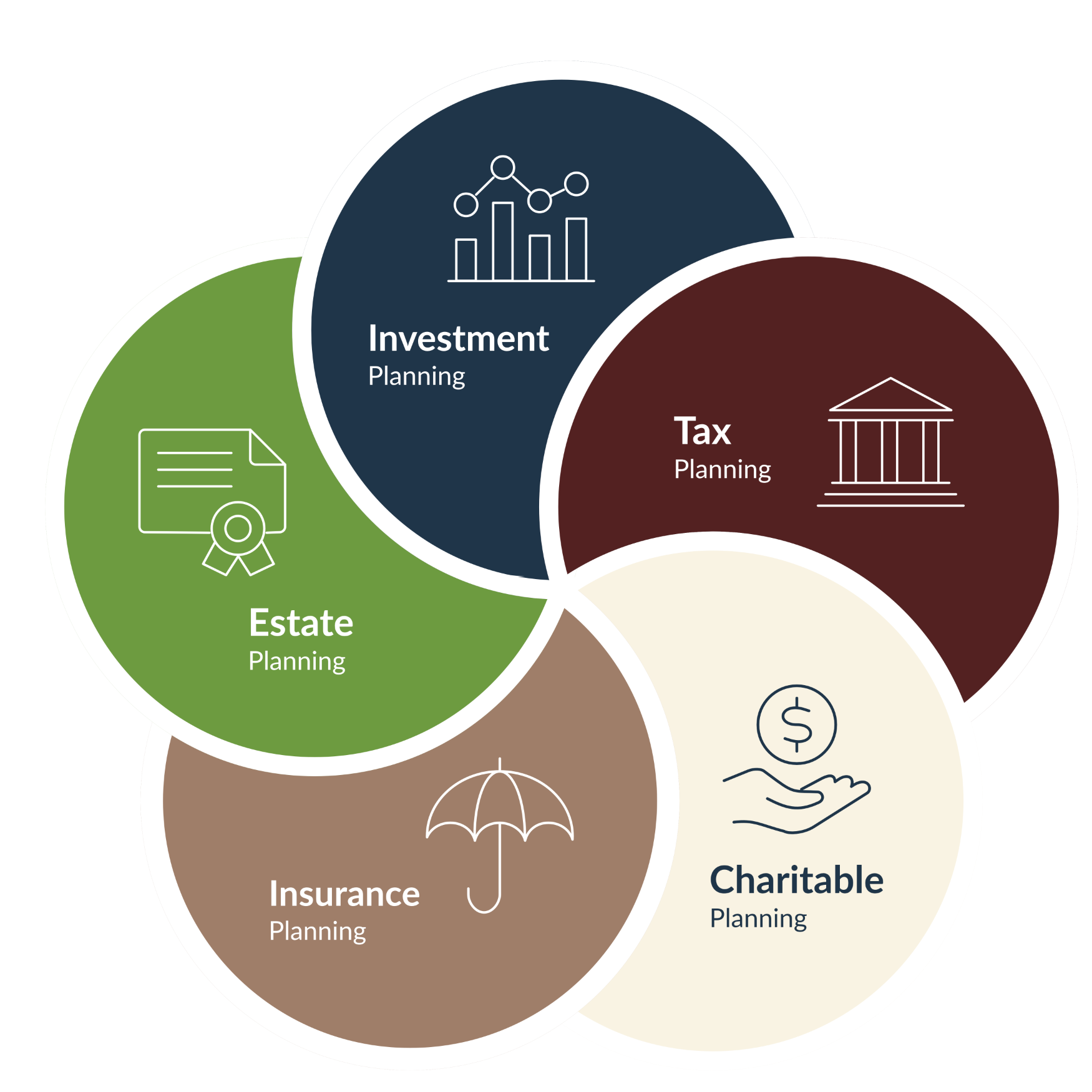

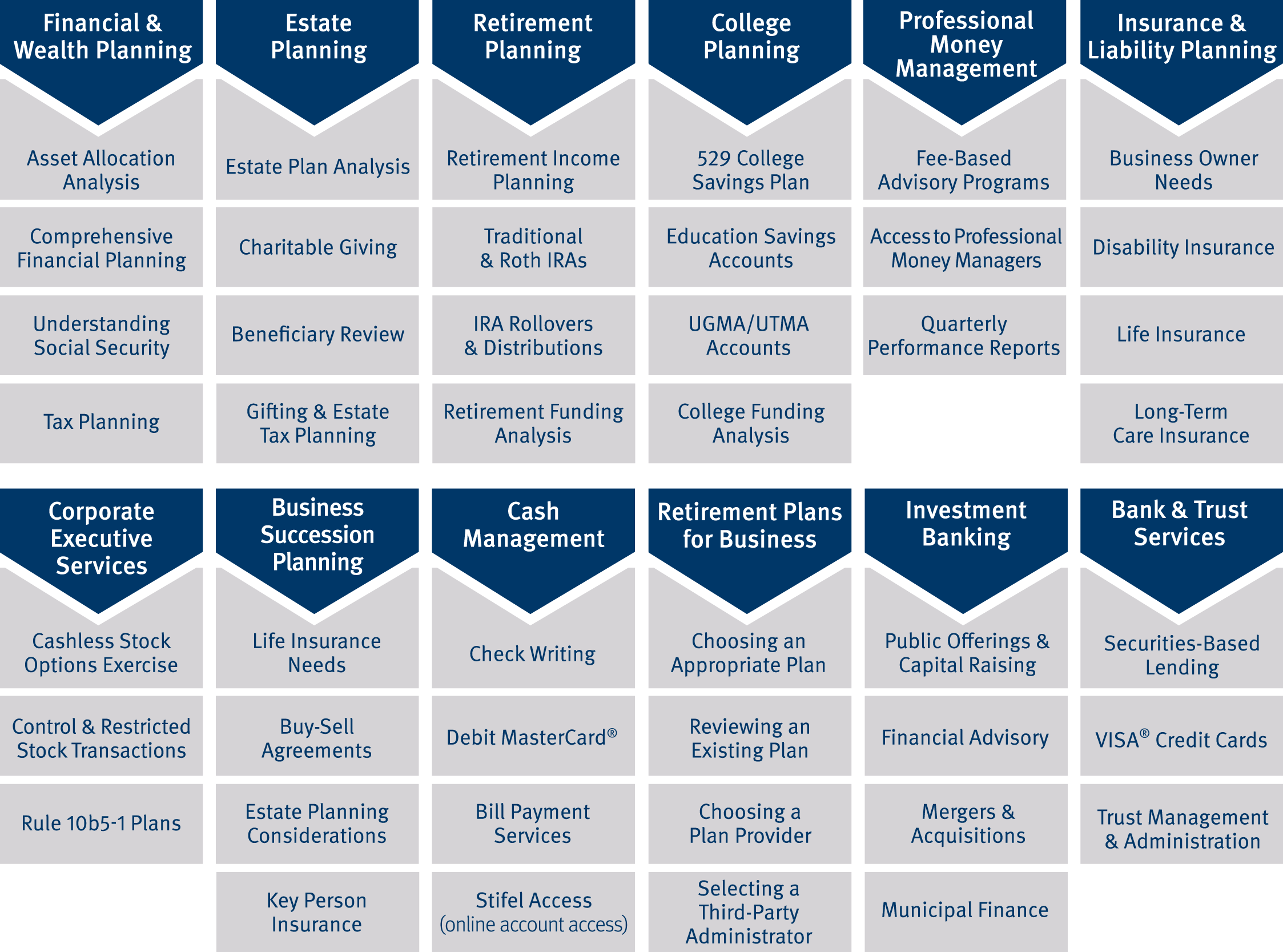

A wealth advisor is a financial professional who provides comprehensive financial planning and investment management services to individuals and families. Their expertise encompasses a wide range of financial disciplines, including:

- Investment Management: Selecting and managing investment portfolios tailored to specific risk tolerances, financial goals, and time horizons.

- Financial Planning: Developing personalized financial plans that encompass retirement planning, estate planning, education funding, insurance needs, and tax optimization.

- Asset Allocation: Strategically distributing assets across different investment classes (stocks, bonds, real estate, etc.) to achieve optimal risk-return profiles.

- Risk Management: Identifying and mitigating potential financial risks through diversification, hedging strategies, and insurance planning.

- Estate Planning: Providing guidance on estate planning strategies, including wills, trusts, and probate avoidance.

The Benefits of Engaging a Wealth Advisor

Engaging a wealth advisor offers numerous benefits, particularly for individuals and families with substantial assets or complex financial situations. These benefits include:

- Objectivity and Expertise: Wealth advisors bring an objective perspective to financial decisions, free from emotional biases that can cloud judgment. They possess specialized knowledge and expertise in financial markets, investment strategies, and tax laws.

- Personalized Strategies: Wealth advisors tailor their services to individual circumstances, taking into account unique financial goals, risk tolerance, and time horizons. This ensures that investment strategies and financial plans are aligned with specific needs.

- Long-Term Perspective: Wealth advisors prioritize long-term financial well-being, considering the impact of current decisions on future financial security. This fosters a disciplined approach to wealth management, minimizing impulsive actions driven by short-term market fluctuations.

- Access to Resources: Wealth advisors have access to a wide range of financial resources, including investment products, research reports, and market data, which are often unavailable to individual investors.

- Time Savings: Wealth management is a time-consuming endeavor, requiring research, analysis, and ongoing monitoring. Engaging a wealth advisor frees up time and energy for other pursuits, while ensuring that financial affairs are managed effectively.

Key Considerations When Selecting a Wealth Advisor

Choosing the right wealth advisor is crucial for achieving successful financial outcomes. Several factors should be considered when making this decision:

- Experience and Credentials: Look for advisors with extensive experience in wealth management and relevant professional certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

- Investment Philosophy: Understand the advisor’s investment philosophy and how it aligns with your own risk tolerance and investment goals.

- Fees and Compensation: Discuss fee structures and compensation arrangements upfront to ensure transparency and avoid any conflicts of interest.

- Communication and Transparency: Choose an advisor who communicates clearly and openly, providing regular updates on portfolio performance and financial planning progress.

- Trust and Compatibility: Establish a strong rapport and trust with your advisor, as this is essential for effective collaboration and long-term success.

Frequently Asked Questions (FAQs)

Q: How much does it cost to hire a wealth advisor?

A: The cost of hiring a wealth advisor varies depending on the advisor’s experience, services offered, and the size of the client’s assets. Fees are typically structured as a percentage of assets under management (AUM), hourly rates, or a combination of both.

Q: What are the different types of wealth advisors?

A: There are various types of wealth advisors, including:

- Registered Investment Advisors (RIAs): Independent advisors who are required to act in the best interests of their clients.

- Broker-Dealers: Financial institutions that offer investment products and services, including wealth management.

- Financial Planners: Professionals who provide comprehensive financial planning services, including investment management, retirement planning, and estate planning.

Q: How do I find a reputable wealth advisor?

A: There are several resources for finding reputable wealth advisors:

- Professional Organizations: Organizations like the Certified Financial Planner Board of Standards (CFP Board) and the CFA Institute offer directories of certified professionals.

- Referrals: Ask friends, family members, or trusted professionals for recommendations.

- Online Resources: Websites like the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC) provide information about registered advisors.

Tips for Effective Wealth Management

- Define Financial Goals: Clearly articulate your financial goals, including retirement planning, education funding, and estate planning objectives.

- Assess Risk Tolerance: Understand your comfort level with risk and how it influences investment decisions.

- Diversify Investments: Spread investments across different asset classes to mitigate risk and enhance returns.

- Regularly Review Financial Plans: Periodically review and adjust financial plans to reflect changes in circumstances, market conditions, and goals.

- Stay Informed: Stay informed about market trends, economic conditions, and financial regulations.

Conclusion

Navigating the complex world of wealth management requires a strategic approach and expert guidance. Engaging a reputable wealth advisor can provide valuable insights, personalized strategies, and ongoing support to achieve financial security and prosperity. By carefully considering the factors outlined above, individuals and families can confidently embark on their wealth management journey, secure in the knowledge that they have a trusted partner by their side.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Complexities of Wealth Management: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin