28, Jan 2024

The Eurozone: A Map Of Monetary Integration And Shared Prosperity

The Eurozone: A Map of Monetary Integration and Shared Prosperity

Related Articles: The Eurozone: A Map of Monetary Integration and Shared Prosperity

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Eurozone: A Map of Monetary Integration and Shared Prosperity. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Eurozone: A Map of Monetary Integration and Shared Prosperity

The Eurozone, a geographical and economic entity encompassing countries that have adopted the euro as their official currency, represents a significant development in European integration. This unique monetary union, established in 1999 and launched in 2002, has profoundly impacted the economies and lives of its member states.

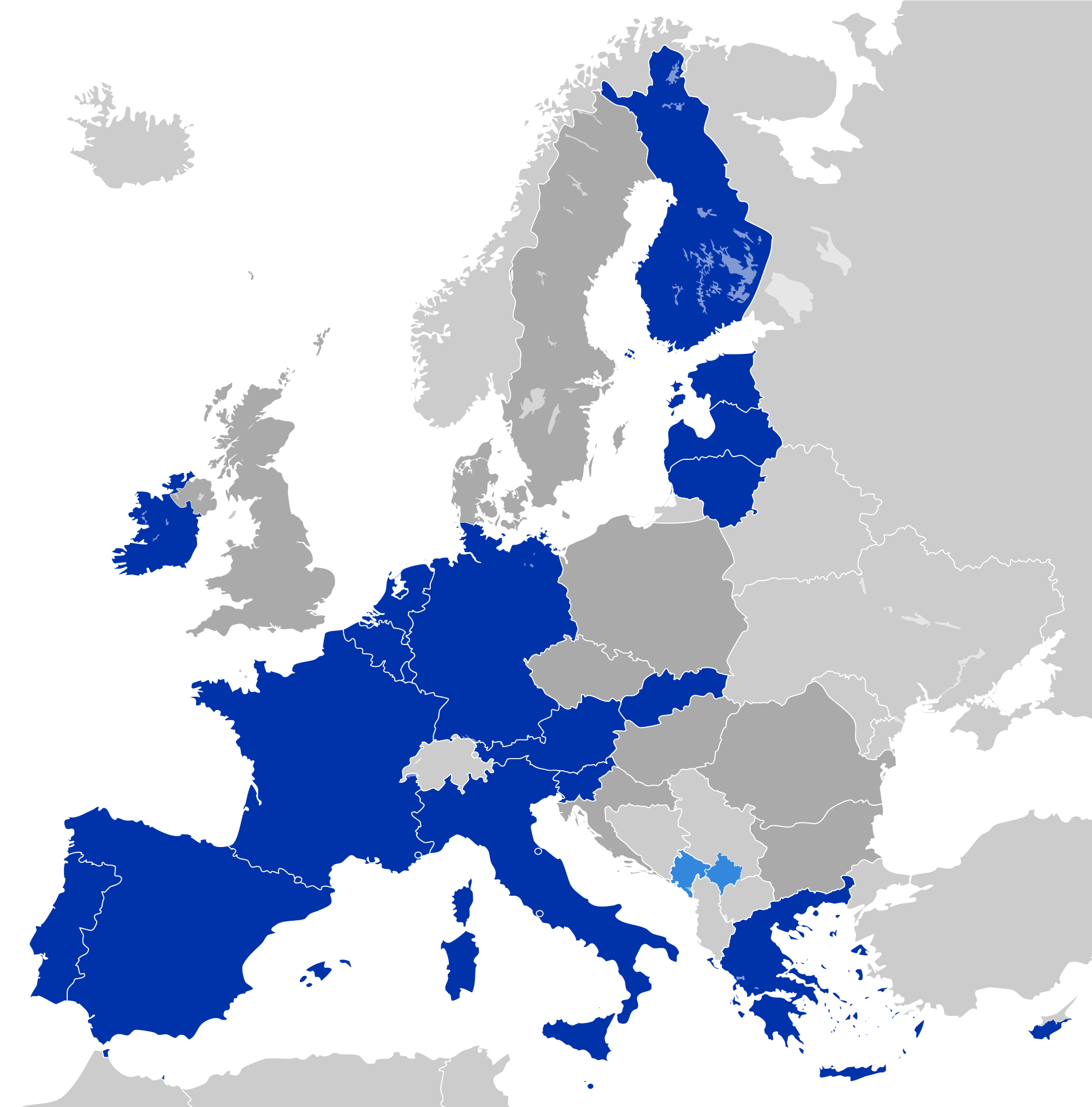

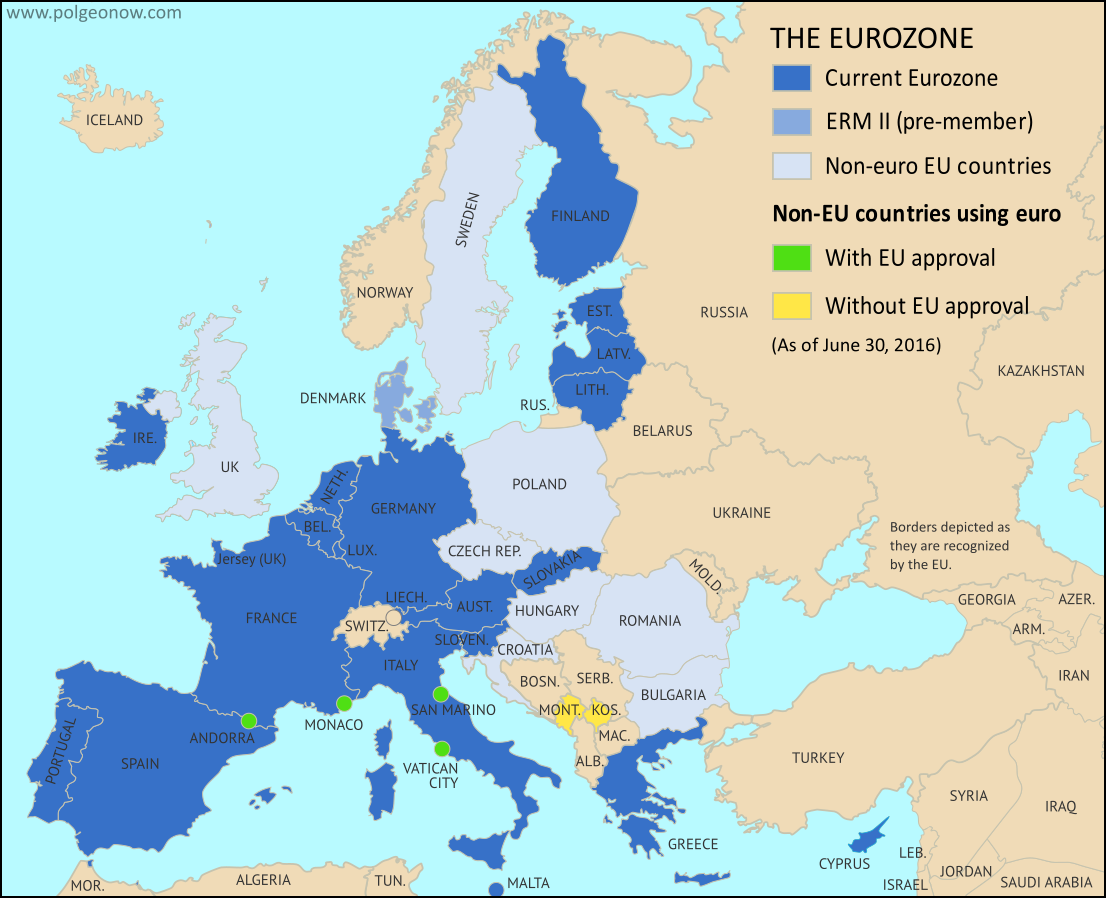

A Visual Representation of Shared Currency:

A map depicting the Eurozone vividly illustrates the geographical scope of this monetary union. It highlights the 20 countries that have adopted the euro, stretching from the Atlantic coast of Ireland to the eastern borders of Slovakia and Slovenia. The map showcases the interconnectedness of these nations through their shared currency, emphasizing the unified economic space they constitute.

The Genesis and Evolution of the Eurozone:

The concept of a single currency for Europe emerged in the aftermath of World War II. The European Coal and Steel Community (ECSC), formed in 1951, laid the foundation for economic cooperation, paving the way for the establishment of the European Economic Community (EEC) in 1957. This marked a significant step towards economic integration, ultimately culminating in the signing of the Maastricht Treaty in 1992, which formally established the European Union (EU) and laid out the framework for the euro.

The Eurozone’s inception was driven by several key objectives:

- Economic stability and growth: The shared currency aimed to eliminate exchange rate fluctuations between member states, thereby promoting trade, investment, and economic stability.

- Reduced transaction costs: The elimination of currency exchange fees for businesses and individuals within the Eurozone facilitated cross-border transactions and fostered economic efficiency.

- Enhanced international influence: The euro, as a single currency representing a significant portion of the global economy, aimed to increase the EU’s global economic influence and bargaining power.

Benefits and Challenges of the Eurozone:

The Eurozone has undoubtedly brought about numerous benefits, including:

- Increased trade and investment: The removal of exchange rate barriers has fostered trade and investment between member states, leading to economic growth and job creation.

- Price transparency and competition: The shared currency has facilitated price comparisons between countries, promoting competition and consumer benefits.

- Enhanced financial integration: The euro has fostered a single financial market, enabling easier access to capital and reducing borrowing costs for businesses and individuals.

However, the Eurozone has also encountered challenges, including:

- Loss of national monetary policy: Member states relinquish control over their own interest rates and monetary policy, limiting their ability to respond to specific economic shocks.

- Economic imbalances: The Eurozone’s single currency has exacerbated economic imbalances between member states, as some countries experience higher growth rates and lower inflation than others.

- Fiscal discipline: The lack of a common fiscal policy has presented challenges in coordinating economic responses and ensuring fiscal discipline among member states.

The Future of the Eurozone:

The Eurozone remains a work in progress, with ongoing efforts to address its challenges and strengthen its economic and political foundations. Key areas of focus include:

- Deepening fiscal integration: Implementing measures to enhance fiscal coordination and solidarity among member states, including a common fiscal policy.

- Promoting convergence: Reducing economic disparities between member states through structural reforms and investment in human capital.

- Strengthening the banking union: Creating a single banking supervisor and resolution mechanism to ensure financial stability and reduce systemic risk.

Frequently Asked Questions about the Eurozone:

Q: What are the criteria for joining the Eurozone?

A: Member states must meet the Maastricht criteria, which include:

- Price stability: Inflation must be below the average of the three lowest-inflation EU member states.

- Government finances: The government deficit must be below 3% of GDP, and public debt must be below 60% of GDP.

- Exchange rate stability: The national currency must have been stable within the European Exchange Rate Mechanism (ERM) for at least two years.

- Long-term interest rates: Interest rates must be close to the average of the three lowest-inflation EU member states.

Q: What are the advantages of using the euro?

A: The euro offers several advantages, including:

- Reduced transaction costs

- Increased price transparency

- Enhanced economic stability

- Greater global influence

Q: What are the disadvantages of using the euro?

A: The euro also presents some disadvantages, including:

- Loss of national monetary policy

- Economic imbalances between member states

- Challenges in coordinating fiscal policies

Q: What is the future of the Eurozone?

A: The Eurozone’s future depends on its ability to address its challenges and strengthen its economic and political foundations. Key areas of focus include deepening fiscal integration, promoting convergence, and strengthening the banking union.

Tips for Understanding the Eurozone:

- Consult reliable sources: Refer to reputable organizations such as the European Central Bank (ECB), the European Commission, and international financial institutions for accurate information about the Eurozone.

- Study the history of European integration: Understanding the historical context of the Eurozone’s creation and evolution provides valuable insights into its current state and future prospects.

- Follow economic developments in the Eurozone: Keep abreast of economic indicators such as inflation, growth rates, and unemployment to understand the current state of the Eurozone’s economy.

- Engage in informed discussions: Participate in discussions about the Eurozone, sharing your knowledge and perspectives while being open to different viewpoints.

Conclusion:

The Eurozone represents a significant step in European integration, fostering economic cooperation and shared prosperity among its member states. While challenges remain, the Eurozone’s success hinges on its ability to address these issues and continue to strengthen its economic and political foundations. By fostering economic convergence, deepening fiscal integration, and strengthening the banking union, the Eurozone can further enhance its stability, resilience, and global influence.

Closure

Thus, we hope this article has provided valuable insights into The Eurozone: A Map of Monetary Integration and Shared Prosperity. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin