24, Mar 2024

The Eurozone: A Single Currency, A Diverse Landscape

The Eurozone: A Single Currency, A Diverse Landscape

Related Articles: The Eurozone: A Single Currency, A Diverse Landscape

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Eurozone: A Single Currency, A Diverse Landscape. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Eurozone: A Single Currency, A Diverse Landscape

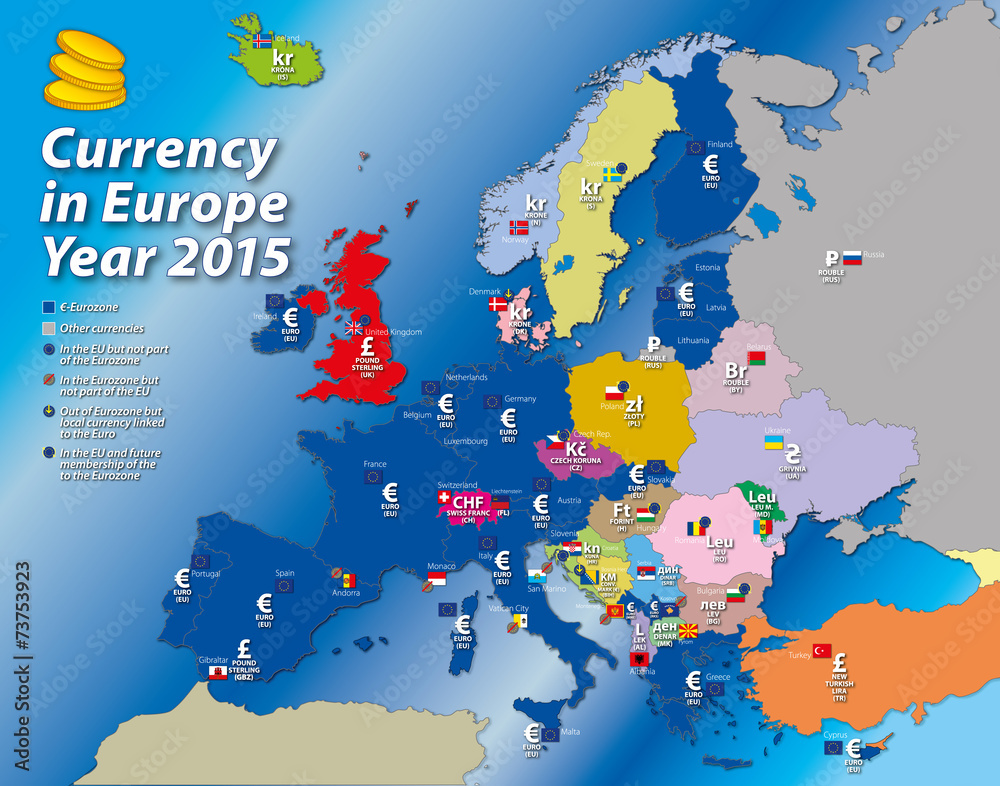

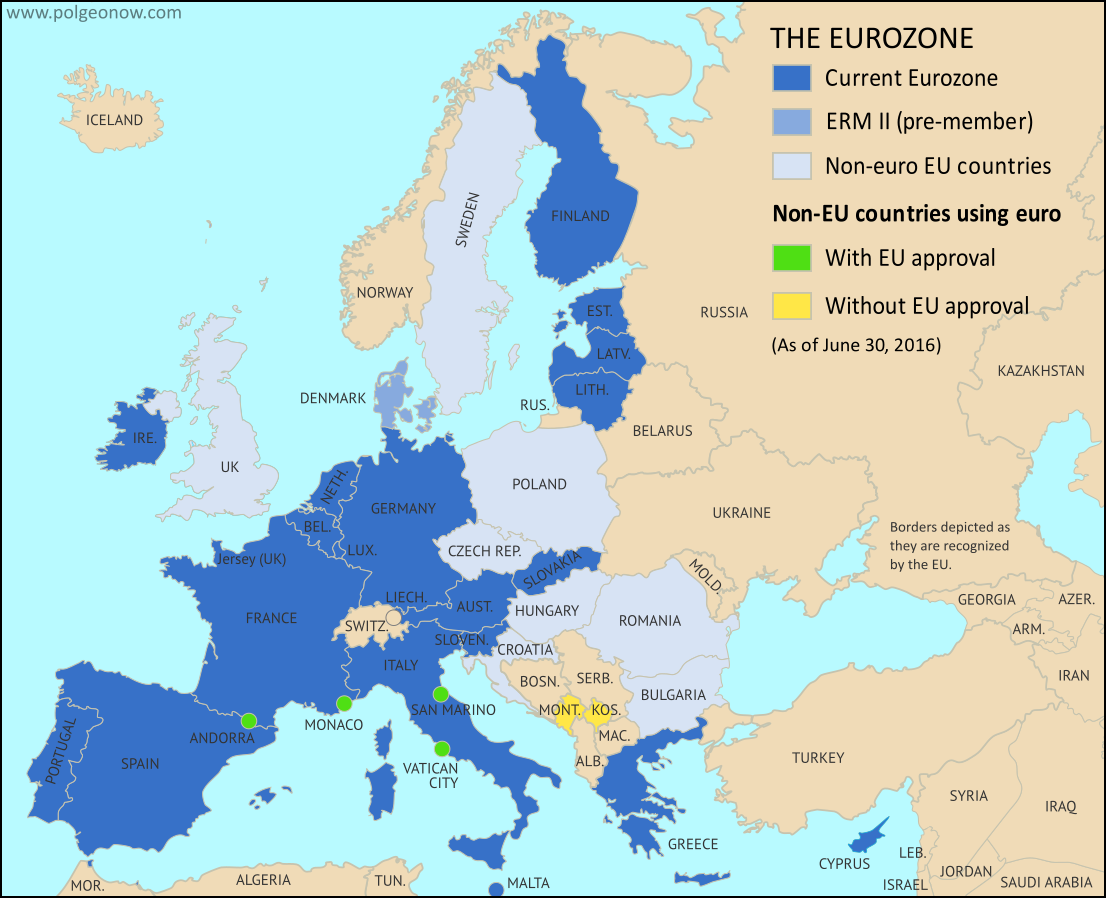

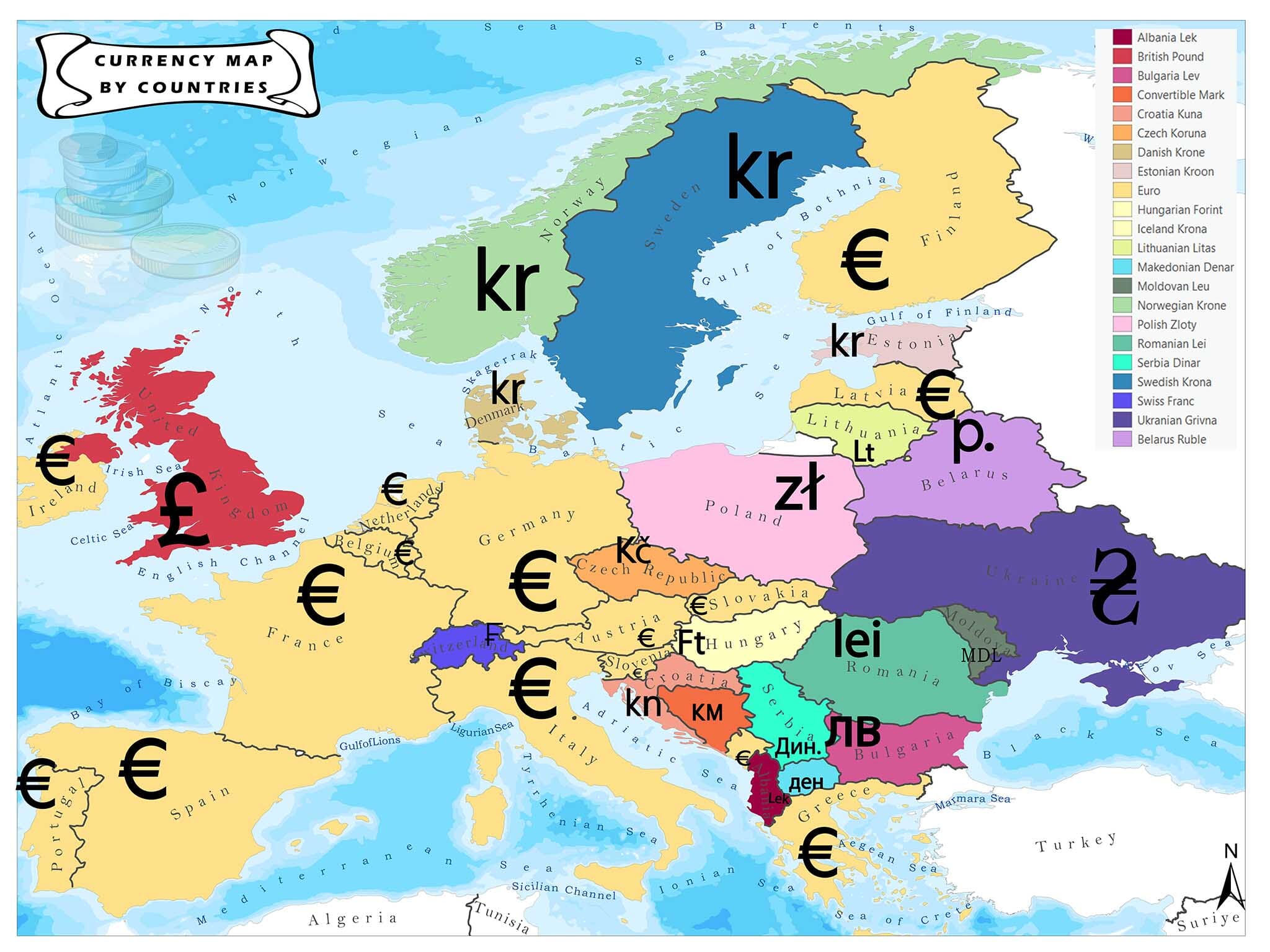

The euro, introduced in 1999, stands as a symbol of economic integration within Europe. Its adoption by nineteen member states of the European Union, collectively known as the Eurozone, has significantly impacted the economic and political landscape of the continent. This article explores the diverse countries that comprise the Eurozone, examining the historical and economic factors that led to their adoption of the single currency, and analyzing its impact on their respective economies.

The Eurozone: A Geographical and Economic Mosaic

The Eurozone is a geographically diverse region, spanning from the Atlantic coast of Portugal to the Baltic Sea in Lithuania. Its member states vary greatly in terms of economic development, cultural heritage, and political systems. This diversity poses both challenges and opportunities for the Eurozone as a whole.

Founding Members:

- Austria: Austria, a prosperous and stable country with a long history of economic integration, was a natural choice for Eurozone membership. Its adoption of the euro has facilitated trade and investment with other member states, contributing to its continued economic growth.

- Belgium: Belgium, a highly industrialized nation with a strong financial sector, joined the Eurozone as a founding member. The euro has helped to stabilize the Belgian economy, particularly during periods of economic uncertainty.

- Finland: Finland, known for its technological innovation and strong export sector, has benefited from the euro’s stability and its role in facilitating international trade.

- France: France, a major economic power in Europe, played a key role in the creation of the euro. The single currency has helped to reduce exchange rate volatility and promote trade within the Eurozone.

- Germany: Germany, the economic powerhouse of Europe, was instrumental in the establishment of the euro. The euro has helped to solidify Germany’s economic dominance and promote its export-oriented economy.

- Ireland: Ireland, a country with a strong tradition of international trade, adopted the euro in 1999. The euro has helped to stabilize the Irish economy and attract foreign investment.

- Italy: Italy, a large and diverse economy, has experienced both benefits and challenges since adopting the euro. The euro has helped to reduce inflation and interest rates, but it has also made it more difficult for Italy to adjust to economic shocks.

- Luxembourg: Luxembourg, a small but wealthy country with a highly developed financial sector, has benefited from the euro’s stability and its role in facilitating cross-border financial transactions.

- Netherlands: The Netherlands, a country with a strong export sector and a stable economy, has seen its economy further strengthen with the adoption of the euro.

- Portugal: Portugal, a country with a history of economic instability, adopted the euro in 1999. The euro has helped to stabilize the Portuguese economy, but it has also made it more difficult for Portugal to adjust to economic shocks.

- Spain: Spain, a country with a diverse economy, has experienced both benefits and challenges since adopting the euro. The euro has helped to reduce inflation and interest rates, but it has also made it more difficult for Spain to adjust to economic shocks.

Later Additions:

- Cyprus: Cyprus, an island nation with a strong tourism sector, joined the Eurozone in 2008. The euro has helped to stabilize the Cypriot economy and attract foreign investment.

- Estonia: Estonia, a small but technologically advanced country, joined the Eurozone in 2011. The euro has helped to stabilize the Estonian economy and promote its export sector.

- Greece: Greece, a country with a long history of economic instability, joined the Eurozone in 2001. The euro has helped to reduce inflation and interest rates, but Greece’s economic problems have intensified since joining the Eurozone.

- Latvia: Latvia, a small but rapidly developing country, joined the Eurozone in 2014. The euro has helped to stabilize the Latvian economy and attract foreign investment.

- Lithuania: Lithuania, a small but rapidly developing country, joined the Eurozone in 2015. The euro has helped to stabilize the Lithuanian economy and promote its export sector.

- Malta: Malta, a small island nation with a strong tourism sector, joined the Eurozone in 2008. The euro has helped to stabilize the Maltese economy and attract foreign investment.

- Slovakia: Slovakia, a country with a strong industrial sector, joined the Eurozone in 2009. The euro has helped to stabilize the Slovakian economy and promote its export sector.

- Slovenia: Slovenia, a small but prosperous country with a strong export sector, joined the Eurozone in 2007. The euro has helped to stabilize the Slovenian economy and attract foreign investment.

Challenges and Opportunities

The Eurozone has faced numerous challenges since its inception, including the global financial crisis of 2008-2009 and the sovereign debt crisis of 2010-2012. These crises have highlighted the challenges of managing a single currency across diverse economies with varying levels of economic performance.

However, the Eurozone also presents significant opportunities for its member states. The single currency has facilitated trade and investment within the Eurozone, leading to increased economic growth and prosperity. The euro has also helped to reduce exchange rate volatility, making it easier for businesses to plan and invest.

FAQs about the Eurozone

Q: What are the benefits of using the euro?

A: The euro offers several benefits, including:

- Reduced exchange rate volatility: This makes it easier for businesses to trade and invest across borders.

- Increased price transparency: Consumers can easily compare prices across different countries, leading to increased competition and lower prices.

- Improved financial stability: The euro has helped to stabilize the economies of Eurozone member states, particularly during periods of economic uncertainty.

- Enhanced economic integration: The euro has facilitated trade and investment within the Eurozone, leading to increased economic growth and prosperity.

Q: What are the challenges of using the euro?

A: The euro also presents some challenges, including:

- Lack of flexibility in monetary policy: The Eurozone has a single monetary policy, which may not be appropriate for all member states.

- Fiscal imbalances: Differences in fiscal policies across member states can lead to economic instability.

- Political challenges: The euro has been subject to political challenges, particularly during periods of economic difficulty.

Q: What are the criteria for joining the Eurozone?

A: To join the Eurozone, a country must meet the following criteria:

- Price stability: The country’s inflation rate must be close to the average of the three best-performing Eurozone countries.

- Government finances: The country’s government debt and deficit must be within specific limits.

- Exchange rate stability: The country’s currency must have been stable against the euro for at least two years prior to joining the Eurozone.

- Convergence criteria: The country’s interest rates, long-term interest rates, and inflation rate must be close to the average of the three best-performing Eurozone countries.

Q: What is the future of the Eurozone?

A: The future of the Eurozone is uncertain. The Eurozone has faced numerous challenges in recent years, but it has also shown resilience and adaptability. The Eurozone’s future will depend on its ability to address these challenges and to continue to foster economic integration among its member states.

Tips for Businesses Operating in the Eurozone

- Understand the legal and regulatory environment: The Eurozone has a complex legal and regulatory environment, which businesses need to understand to operate effectively.

- Manage exchange rate risk: The euro is subject to exchange rate fluctuations, which businesses need to manage to avoid financial losses.

- Develop a strong understanding of the Eurozone economy: Businesses need to understand the economic conditions in the Eurozone to make informed decisions.

- Network with other businesses: Networking with other businesses operating in the Eurozone can provide valuable insights and opportunities.

Conclusion

The Eurozone stands as a testament to the ambition of economic integration in Europe. While the journey has been marked by challenges, the Eurozone’s resilience and the shared commitment of its member states have ensured its continued existence. The euro’s impact on the economies of its member states is undeniable, shaping their economic trajectory and fostering a sense of shared prosperity. As the Eurozone continues to evolve, its future will depend on its ability to navigate the complexities of managing a single currency across diverse economies, fostering greater economic integration, and addressing the challenges that lie ahead.

Closure

Thus, we hope this article has provided valuable insights into The Eurozone: A Single Currency, A Diverse Landscape. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin